Tracking Value-Based Payment Growth and the Shift Towards Assuming Risk

Exploring the Evolution and Future of Value-Based Payments in the Healthcare Industry

THE VBP Blog

December 14, 2023 – Value-based payments (VBP) have emerged as a pivotal model in the healthcare industry, marking a significant shift from traditional fee-for-service approaches. This model incentivizes healthcare providers not just for the volume of care they deliver, but for the quality and efficiency of that care. The transformation approach aims to enhance patient outcomes while controlling healthcare costs.

Value-based payments are not a new concept and as the healthcare industry continues to evolve, it’s important to understand the current state of VBP. In this blog, we delve into the dynamics of value-based payments and explore its expansion beyond the realm of Medicare into broader applications with private payers.

Value-Based Payment Arrangements Expanding Beyond Medicare

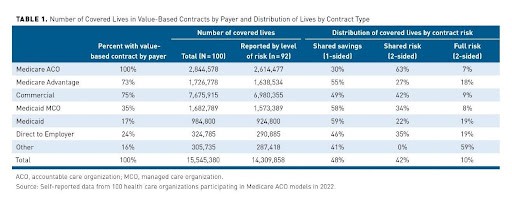

Value-based payments (VBP) is witnessing a significant expansion, with an increasing number of provider organizations embracing VBP contracts beyond Medicare, venturing into agreements with private payers. A recent study published in the American Journal of Managed Care found that approximately 75% of respondents were under contracts with commercial and Medicare Advantage plans in 2022. This shift indicates a growing recognition of the effectiveness of VBP models across various healthcare settings and payer types.

Historically, VBP models were predominantly associated with Medicare, owing to initiatives like the Medicare Shared Savings Program (MSSP) and various other federal efforts. However, recent trends show a broader adoption. Private payers, including insurance companies and employer-sponsored plans, are now actively pursuing VBP arrangements. Another recent study conducted by Sage Growth Partners on behalf of Azara Healthcare showed that 85% of healthcare organizations of all sizes reported being very familiar with value-based care and said they are actively working to expand its footprint. 70% of respondents also noted that in three years, a significant share of their revenue will come from a mix of value-based care models.

The expansion of VBP into private payer contracts reflects a growing consensus on the need for a healthcare system that prioritizes value over volume. This approach can potentially lead to overall better health outcomes for patients, more satisfaction for providers, and a sustainable model for payers. However, it is important to note that these studies and data primarily cover the physical health side. The human services segment of the health care industry, including long term services and supports (LTSS), intellectual and developmental disabilities (IDD), and behavioral health (BH), still lag when it comes to value-based payments. These beneficiaries are perhaps the ones that would benefit the most from value-based payment models. That is because under VBP, there is a heightened emphasis on delivering care that is not only cost-effective but also tailored to the individual’s specific needs. This approach can significantly enhance the quality of services provided in the LTSS, IDD, and BH arenas, ensuring that services are more personalized, outcome-focused, and integrated. These models also encourage providers to innovate in their care strategies, moving beyond traditional care models to ones that actively promote independence, community integration, and overall well-being.

While it’s clear that value-based payments would be beneficial for LTSS, IDD, and behavioral health, there are obstacles to implementation. Providing services to elderly and IDD community is often more costly, and providers are reluctant to take on that added risk. There is also the notion of performance metrics. The shift to value-based payments necessitates a careful consideration of how value is defined and measured in the context of care, ensuring that the metrics used truly capture the nuances and complexities of supporting these unique and complex populations. However, as we see more providers shift to VBP and gain comfort in taking on more risk, we hope that the expansion of value-based payments continues into these areas of care.

Providers Embracing Increased Risk in Value-Based Payment Models

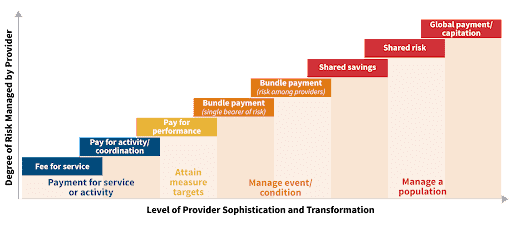

While it’s clear that value-based payment models are on the rise, something else to consider is the level of risk that payers and providers are willing to accept. Under value-based payments, due to the need to ease providers into more advanced VBP models, a VBP continuum was created. This spectrum of VBP models as seen below, ranges from ones that mirror FFS to advanced models that have two-sided risk.

The recent trajectory of value-based payments (VBP) is increasingly characterized by healthcare providers taking on more risk, a significant evolution from earlier, less risky models. This shift down the value-based payment continuum means providers are moving towards arrangements that involve greater accountability for both the cost and quality of care provided to patients.

Traditionally, VBPs started with models that posed minimal risk, such as pay-for-performance or shared savings programs where providers could earn more for meeting certain quality benchmarks without significant penalties for underperformance. However, as the VBP model matures, providers are increasingly engaging in more sophisticated arrangements like bundled payments, shared risk, and even full capitation models. In these models, providers are not only rewarded for meeting quality and efficiency targets but also face financial consequences if they fail to do so. This transition reflects a growing confidence in the ability to manage care effectively under value-based payment framework.

Looking back at the AJMC study, it’s clear the providers are still favoring the shared savings and shared risk models, over the full risk 2-sided model.

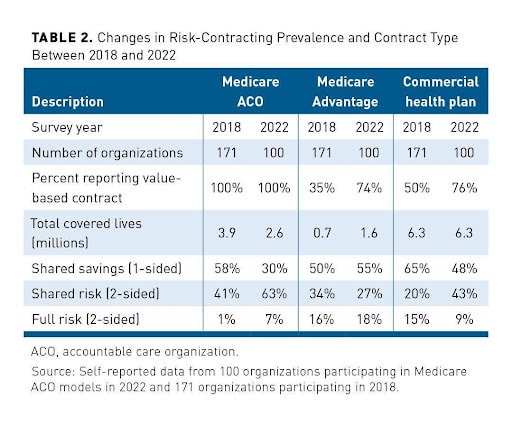

The positive note here is that the shift towards taking on more risk is occurring. Comparing the 2022 numbers from the 2018 numbers, as seen in the chart below from AJMC, it is clear that value-based payment contracts have more risk.

But what does this mean for the most important stakeholders – the consumers? The shift towards higher-risk value-based payment contracts has profound implications for them. As providers take on more risk, they have greater incentive to ensure that care is not only high quality but also cost-effective. This can lead to better coordination among different healthcare providers and more investment in preventive care and early intervention. By doing this, providers strive to reduce the need for expensive treatments or hospitalizations by managing health more proactively, which is something that greatly benefits the consumer.

High-risk value-based payment models also encourage providers to focus on patient outcomes and satisfaction. This often means taking a whole-person care approach to patient health. Providers need to consider someone’s immediate medical needs as well as their overall well-being. That means addressing social determinants of health. Patients may receive more education about their health, more support in managing chronic diseases, as well as coordination with service providers to ensure that health-related social needs are met.

Simply put, these changes create a healthcare system that is more focused on keeping people healthy and out of the hospital, rather than one that is reactive to health problems as they arise. As providers move down the VBP continuum, taking on more risk, the expectation is that the healthcare system will become more efficient, cost-effective, and patient-centered. It is important to highlight that while it’s encouraging to see an increased adoption of value-based payments and higher risk acceptance, this shift also needs to incorporate individuals with more complex needs, including the elderly, beneficiaries with IDD, and those with complex behavioral health and LTSS needs. Under risk-sharing agreements, providers are incentivized to focus on long-term outcomes and preventive care strategies and for the aging population and those with complex medical needs, this means receiving more holistic, coordinated care that also focuses on overall well-being and development. Care plans are likely to be more comprehensive, encompassing not just medical treatments but also therapies and interventions that support cognitive, behavioral, and social development. Under higher risk sharing agreements, healthcare providers are likely to invest more in building long-term relationships with their patients. This is important because consistent care from a dedicated team of healthcare professionals can be particularly beneficial for IDD individuals, who often require a stable and familiar care environment.

Looking at the Road Ahead to Address Gaps in the Growth of Value-Based Payments

The shift towards value-based payments (VBP) and the acceptance of more risk represents a desire to enhance care quality and reduce costs. But despite the growing adoption of these models, there are some obstacles that need to be addressed to fully realize the potential.

- Data and Analytics Challenges: A primary area for enhancement in VBP models lies in data management and analytics. Efficient and effective use of data is crucial for tracking patient outcomes, understanding cost patterns, and making informed decisions. Unfortunately, many providers still struggle with collecting, integrating, and analyzing data from various sources. Whether it’s due to cost, lack of expertise, or lack of manpower, this needs to be addressed. Enhanced data capabilities will enable providers to better identify at-risk populations, track progress towards quality goals, and manage costs more effectively.

- Uneven Adoption Across Providers: While some healthcare providers have fully embraced VBP models, others, especially smaller practices or those in rural areas, find it challenging to transition from the traditional fee-for-service model. This uneven adoption can create disparities in the quality and cost of care and hinders the evolution of health equity. Smaller providers often lack the resources and infrastructure to take on the risk associated with VBP models, making it difficult for them to participate. There is a need for targeted support and resources to help these providers transition to VBP models.

- Complexity of VBP Models: The complexity of VBP contracts is another barrier to their wider adoption. Healthcare providers often have to navigate a labyrinth of performance metrics, reporting requirements, and payment structures. Simplifying these models, standardizing metrics across payers, and providing clear guidelines can help providers better understand and participate in VBP arrangements.

- Patient Engagement and Education: Effective engagement is crucial for the success of value-based payment models. These types of models require consumers to be active participants in their healthcare to receive preventative, whole-person care. Many aren’t accustomed to this so there needs to be more emphasis on involving consumers in care planning and empowering them to make informed decisions about their health.

- Inclusion of IDD and Beneficiaries with Complex Medical Needs: As we’ve noted, the large adoption of value-based payments has primarily been in the physical health arena. While this is encouraging and a promising sign, we cannot ignore other populations with complex medical needs and those requiring LTSS and HCBS. As we discussed in a past blog, coverage for these individuals and services is often on a state-by-state policy basis. We need to continue encouraging the adoption of value-based payments for HCBS and LTSS to ensure that the elderly and IDD communities receive the care they need to remain living comfortably and independently at home.

While value-based payment models offer a promising path towards a more efficient and effective healthcare system, there is still significant work to be done. Addressing these areas of improvement and expansion to care for all is crucial for these models to achieve their full potential and deliver on the promise of better healthcare for all.

Advocates Perspective

The shift from traditional fee-for-service to value-based payment models is continuing and signifies a monumental change in how healthcare is delivered and reimbursed. We are also seeing providers take on more risk in VBP contracts, which is a positive for consumers. However, as the industry progresses, it’s crucial to remember that the goal of VBP is a more patient-centric, outcome-focused healthcare system. This requires not only the alignment of incentives across the healthcare spectrum but also a commitment to including the necessary services to support the elderly and IDD communities. These populations can benefit most through inclusion of LTSS and HCBS services, which typically are not covered under value-based payment arrangements. By addressing the current gaps and leveraging the lessons learned, VBP can evolve into a model that truly reflects the needs of all stakeholders, especially the most vulnerable populations.

Onward!

Share This Blog!

Get even more insights on Linkedin & Twitter

About the Author

Fady Sahhar brings over 30 years of senior management experience working with major multinational companies including Sara Lee, Mobil Oil, Tenneco Packaging, Pactiv, Progressive Insurance, Transitions Optical, PPG Industries and Essilor (France).

His corporate responsibilities included new product development, strategic planning, marketing management, and global sales. He has developed a number of global communications networks, launched products in over 45 countries, and managed a number of branded patented products.

About the Co-Author

Mandy Sahhar provides experience in digital marketing, event management, and business development. Her background has allowed her to get in on the ground floor of marketing efforts including website design, content marketing, and trade show planning. Through her modern approach, she focuses on bringing businesses into the new digital age of marketing through unique approaches and focused content creation. With a passion for communications, she can bring a fresh perspective to an ever-changing industry. Mandy has an MBA with a marketing concentration from Canisius College.