Home Health Care Costs Continue to Rise But Value-Based Payments Can Help

Delve into an analysis of the factors driving up home health and home care costs, from increased demand to inflation, and discover how value-based payments could offer a beacon of hope for consumers facing financial pressures.

THE VBP Blog

March 22, 2024 – With the demand for home health and home care services continuing to grow, their rising costs have become a pressing concern. As more individuals seek to receive medical and personal care in the comfort of their home, the financial implications of these services are increasingly coming to the forefront. This trend towards home-based care, driven by the aging population, technological advancements, and the preference for personalized care settings, has spotlighted the escalating expenses associated with such services. But can value-based payments help with that?

In this blog, we will explore the rising costs of home health and home care, and the factors fueling these increases. More importantly, we will examine the broader implications of these rising costs and analyze how value-based payments can help with the rising cost of home health care. As advocates, we understand the importance of individuals being able to age and live independently in the comfort of their home and are concerned about the impact that the rising costs of these services will have on the industry, as well as quality and accessibility of care. To learn more about our advocate’s perspective, check out our full write up at the end of the blog to hear more of our thoughts!

Home Health Care Costs Continue to Rise

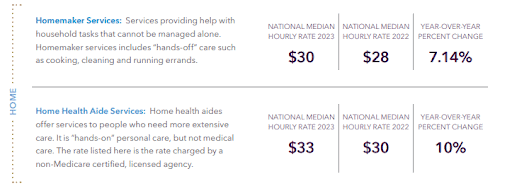

The increasing costs of home health care have become a significant concern across the United States and is highlighted by the latest findings from Genworth’s 2023 Cost of Care Survey. The research includes two years of monitoring long-term care (LTC) expenses. While LTC expenses increased across all provider types, the results reveal a notable escalation in expenses associated with receiving care in one’s own home. As shown below, there was a 10% and 7% increase in home health aide costs and homemaker services, respectively. These are far higher than the increase in other areas like skilled nursing facilities and assisted living, where services are not delivered in one’s home.

Source: Genworth Cost of Care Survey (2023)

Several key drivers contribute to the rising costs of these services. The labor market is the biggest driver as competition for these workers has driven costs up. In addition, the aging population has resulted in a higher demand for home-based care services. As more baby boomers reach retirement age, the need for personalized, in-home care solutions has surged. This has put additional pressure on service costs due to increased demand, especially for providers that do not operate in the private pay arena where higher costs can simply be billed to the consumer.

Operational costs for home health agencies have also risen, with inflation being a main driver. According to insights from Forbes, the general increase in the cost of goods and services has not spared the healthcare sector. From medical supplies to operational expenses, the industry is facing rising costs on multiple fronts. These increased operational costs, in turn, trickle down to consumers, driving up the cost of receiving care at home.

Due to all these cost increases, agencies face the challenge of balancing the need to provide high-quality, personalized care with the escalating costs associated with these services. And, as the need for home health and home care services continues to grow, we need to find quick solutions.

Value-Based Payments Have Made an Impact in Home Health Sector

As the costs associated with home health and home care services continue to rise, the healthcare industry sought innovative payment models to mitigate financial pressures while still ensuring high-quality care. Among these, value-based payments (VBP) stood out as a promising solution. Value-based payment models shift the focus from traditional fee-for-service (FFS) models that pay providers based on the quantity of care services delivered, to a model that rewards providers for the quality and outcomes of care.

The transition to value-based payments has shown success. In fact, the Centers for Medicare & Medicaid Services (CMS) released the Home Health Value-Based Purchasing (HHVBP) Model in 2016. This was a pilot program in 9 states that was designed to test whether providing payment incentives based on better quality of care with great efficiency would improve the delivery and quality of home health care services for Medicare beneficiaries. The model was successful, with reports showing an increase in quality of care and a decrease in overall costs. This led CMS to expand the model nationwide, starting in 2023, and we will continue to keep an eye on how the model performs over a larger scale.

This is promising, but it is only a small piece of the picture. By 2030, CMS predicts that Medicare and Medicaid will be spending $300 billion annually for home care and nursing facilities. Can value-based payments have a larger impact through continued expansion into the home health and non-medical home care sectors?

Can Value-Based Payments Keep Home Health Care Accessible and Ensure Quality?

The $300 billion Medicare and Medicaid are projected to spend annually for home care and nursing facilities is simply not sustainable, but there are solutions. When you look at the fact that home care can cost 30% less than nursing home care, in terms of the total cost of caring for individuals, the shift to home-based care is going to be a continued focus. While some individuals require the higher-level care that skilled nursing facilities provide, in most instances, home care is preferred by aging adults who want to remain in the comfort of their home.

The good news is that value-based payment models have the potential to significantly impact the economics of home health care. This was shown in a limited sample through the HHVBP model, but by aligning financial incentives with health outcomes, VBP models encourage providers to deliver care that is not only effective but also efficient. This model fosters an environment where providers are motivated to implement preventive measures, manage chronic conditions effectively, and avoid unnecessary hospitalizations. All these benefits contribute to reducing overall healthcare costs.

Moreover, value-based payments can drive innovation in care delivery. Home health agencies might be more inclined to adopt new technologies and care coordination strategies that enhance monitoring, improve communication among caregivers, and facilitate timely interventions. These advancements can lead to better health outcomes for consumers and, subsequently, lower costs for care providers and payers.

Implementing value-based payments in home health care also emphasizes the importance of personalized care plans. Providers are encouraged to understand the unique needs of each consumer and to tailor their services accordingly, which can lead to more effective and satisfying care experiences. This patient-centered approach not only improves quality of life for those receiving care but also contributes to the sustainability of healthcare systems by reducing wasteful spending. However, for this to be effectively incentivized, payers need to be aligned when establishing the performance and quality measures by which providers will be graded on. The agencies will focus on payer priorities, as this is how they are reimbursed, which means careful consideration and collaboration needs to occur when establishing these measures.

What Are the Next Steps for Value-Based Payments in Home Health and Home Care?

In theory, and in the small samples we’ve seen, value-based payments can make a big impact in keeping home health costs down. But what are the next steps? Time will tell how the CMS Expanded HHVBP Model delivers across the entire country, which is something we will keep a close eye on, but it is also important to note that this model does not apply to everyone.

The Expanded HHVBP model only applies to Medicare beneficiaries receiving care through home health agencies (HHAs). Also, for those without Medicare Advantage or supplemental insurance, only the first 100 days of service is covered in a 12-month period. Those needing year-round care will either go without necessary services or rack up lofty medical bills. Declining health resulting from lack of services can increase the cost that Medicare is on the hook for as beneficiaries may require other services or hospitalization.

CMS touts a goal of health equity, but those without Medicare Advantage plans or secondary insurance will not fare well. It would be encouraging to see an increase in the 100-day limit to ensure that consumers can receive the care they need to remain living independently at home year-round without missing services or falling into medical debt.

The Expanded HHVBP Model also only addresses medical home health services. Something that cannot be overlooked in home care, which we believe could be the next frontier for value-based payments. Home care encompasses non-medical services like bathing and getting dressed, household chores like cleaning and laundry, meal preparation, and transportation that also have an impact on overall health. A home care VBP model can improve quality of life for those aging at home as it will incentivize compassionate care and give consumers a voice that they may not have had previously. This is a win for consumers and needs to be seriously considered by CMS and providers.

As the population continues to age and more and more consumers are looking for both medical and non-medical services in the home, value-based payments serve as a logical solution to reduce costs while also ensuring quality of care.

Advocates Perspective

The rising costs of home health and home care services pose a significant challenge for consumers and the healthcare system alike. Driven by an increased demand for services, an aging population, and the pervasive impact of inflation, these escalating expenses underscore the need for innovative solutions and strategic planning. Value-based payments offer a viable strategy to mitigate rising costs while maintaining, or even enhancing, the quality of care. By shifting the focus towards outcomes and efficiency, these models incentivize providers to adopt practices that not only meet consumer needs but also reduce unnecessary expenditures. This shift towards value-based care represents a significant evolution in the healthcare payment landscape, promising benefits for consumers, providers, and the system at large. However, there are some areas of concern that can limit the effectiveness, including home health care only being covered for the first 100 days a year, and non-medical home care services not being included. This is something that we would like to see addressed, as there is potential for it to have a big impact on health outcomes for those seeking to live and age independently at home. We also need to ensure equitable and fair wages for caregivers. This will not only help ensure that consumers maintain access to quality care, but also ensure that caregivers get a living wage.

Onward!

Share This Blog!

Get even more insights on Linkedin & Twitter

About the Author

Fady Sahhar brings over 30 years of senior management experience working with major multinational companies including Sara Lee, Mobil Oil, Tenneco Packaging, Pactiv, Progressive Insurance, Transitions Optical, PPG Industries and Essilor (France).

His corporate responsibilities included new product development, strategic planning, marketing management, and global sales. He has developed a number of global communications networks, launched products in over 45 countries, and managed a number of branded patented products.

About the Co-Author

Mandy Sahhar provides experience in digital marketing, event management, and business development. Her background has allowed her to get in on the ground floor of marketing efforts including website design, content marketing, and trade show planning. Through her modern approach, she focuses on bringing businesses into the new digital age of marketing through unique approaches and focused content creation. With a passion for communications, she can bring a fresh perspective to an ever-changing industry. Mandy has an MBA with a marketing concentration from Canisius College.