AMA Study Shows Increasing Consolidation in Health Insurance Industry

AMA argues that increased consolidation can restrict consumers’ options for coverage

Sept 30, 2021 – The American Medical Association (AMA) recently released a report regarding competition in the health insurance industry. In the 20th edition of Competition in health insurance: A comprehensive study of U.S. markets, AMA presents data on the degree of competition in health insurance markets across the country.

The report is designed to help policymakers, researchers, and regulators aware of the markets where consolidation of health insurance providers might cause harm and restrict consumers’ options for coverage. Explicitly, the study looks to answer two questions:

- Are health insurance markets competitive or do health insurers possess market power?

- Are proposed mergers involving insurers likely to maintain, enhance or create such power?

Unfortunately, the study found that the consolidation of health insurance companies has increased significantly from 2014 to 2020.

Consolidation of Health Insurance Study Findings

The AMA study found that the majority of U.S. Commercial health insurance markets are highly concentrated. While there have been fluctuations over the years, both the share of highly concentrated markets and the average market concentration increased between 2014 and 2020.

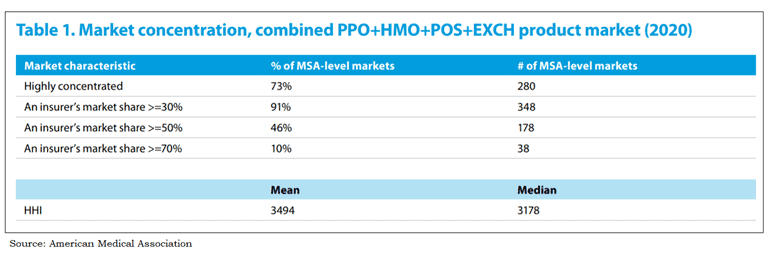

Looking at MSA-level findings on market concentration below, it is clear that a majority of MSA’s-level markets are highly concentrated. 73% of markets are highly concentrated, and in 91% of markets, at least one health insurance company had a market share of at least 30%.

The AMA study found that the majority of U.S. Commercial health insurance markets are highly concentrated. While there have been fluctuations over the years, both the share of highly concentrated markets and the average market concentration increased between 2014 and 2020.

Looking at MSA-level findings on market concentration below, it is clear that a majority of MSA’s-level markets are highly concentrated. 73% of markets are highly concentrated, and in 91% of markets, at least one health insurance company had a market share of at least 30%.

AMA Is Pushing for Scrutinization of Future Mergers

The way to combat this consolidation is for lawmakers, policymakers, and federal and state regulators to further scrutinize future mergers.

“As merger rumors involving health insurers swirl, the prospect of future consolidation in the health insurance industry should be more closely scrutinized given the low levels of competition in most health insurance markets,” said AMA President Gerald E. Harmon, M.D in a recent press release. “For two decades, the AMA study has been helping researchers, lawmakers, policymakers, and federal and state regulators identify markets where consolidation involving health insurers may cause competitive harm to consumers and providers of care.”

AMA believes that the study and its frequent publication is a way to continue its antitrust advocacy as a way to shield both consumers and physicians from competitive harm.

For the entire 20th edition of Competition in health insurance: A comprehensive study of U.S. markets, click here.

Content from the 2021 updated study is available for download from the AMA’s Competition in Health Insurance Research website by clicking here.

The VBP Blog is a comprehensive resource for all things related to value-based payments. Up-to-date news, informative webinars, and relevant blogs in the VBP sphere to help your organization find success.